Private Loans, Public Complaints

The CFPB's Consumer Complaint Database Gets Real Results for Student Borrowers

In this report we explore consumer complaints in the private student loan sector with the aim of uncovering patterns in the problems consumers are experiencing with their student loans.

The Consumer Financial Protection Bureau (CFPB) was established in 2010 in the wake of the worst financial crisis in decades. Its mission is to identify dangerous and unfair financial practices, to educate consumers about these practices, and to regulate the financial institutions that perpetuate them.

To help accomplish these goals, the CFPB has created and made available to the public the Consumer Complaint Database. The database tracks complaints made by consumers to the CFPB and how they are resolved. The Consumer Complaint Database enables the CFPB to identify financial practices that threaten to harm consumers and enables the public to evaluate both the performance of the financial industry and of the CFPB.

This report is the second of several that will review complaints to the CFPB nationally and on a state-by-state level. In this report we explore consumer complaints in the private student loan sector with the aim of uncovering patterns in the problems consumers are experiencing with their student loans.

Student consumers can obtain federal student loans, private student loans or both to pay for higher education. Private student loans (PSLs) are typically far more risky and expensive for consumers seeking a way to pay for college. Private student loans, like credit cards, generally offer variable interest rates that are higher for those borrowers with the least means. Repayment options are also severely limited. Federal student loans, by contrast, are typically subsidized at a fixed interest rate and offer repayment options like deferment, income-based repayment and loan forgiveness that can help the borrowers respond to job changes, job loss, illness or other changes in income.

PSLs accounted for about 7 percent of all student education loans taken out last year, and account for 15 percent of outstanding student loan debt in the United States. The current debt owed by consumers in the United States on their private student loans is estimated to be approximately $165 billion.

Since the Consumer Financial Protection Bureau began collecting data on private student loans in March 2012, the CFPB has recorded more than 4,300 complaints about problems with private student loans.*

· Sallie Mae was by far the most complained-about private student loan firm. Sallie Mae is a behemoth in the PSL marketplace, with an estimated 50 percent market share. However, its share of total complaints to the CFPB was lower than its market share. The Pennsylvania Higher Education Assistance Authority (AES/PHEAA), which has purchased several private student loan portfolios and acts as the servicer for other private student firms, ranked second. Wells Fargo, which is the second largest private student lender behind Sallie Mae, ranked third. Ten U S. private student lenders and servicers account for about 90 percent of all complaints to the CFPB.

· Repayment of loans (including fees, billing, deferment, forbearance, fraud and credit reporting) was by far the most common subject of complaints to the CFPB. Loan repayment was the subject of nearly 65 percent of complaints filed.

· Sallie Mae, the largest PSL lender, received the largest number of complaints in all three complaint categories that the CFPB tracks. The company received 1,983 complaints – more than the next nine companies combined, and 46 percent of all student complaints filed with the CFPB.

· In most cases, lenders and servicers that received high total numbers of complaints also ranked toward the top for complaints across all three issues tracked by the CFPB (issues related to getting loans, inability to pay and loan repayment). AES/PHEAA, for example, was second in both complaints about loan repayment and problems resulting from inability to pay (such as issues related to default, debt collection and bankruptcy), as well as second in complaints overall.

Complaints about private student loans vary by state, and state residents vary in their tendency to reach out to the CFPB.

· Sallie Mae was the most complained-about lender in 48 states. However, its size and dominance in the PSL market renders comparison to other lenders difficult.

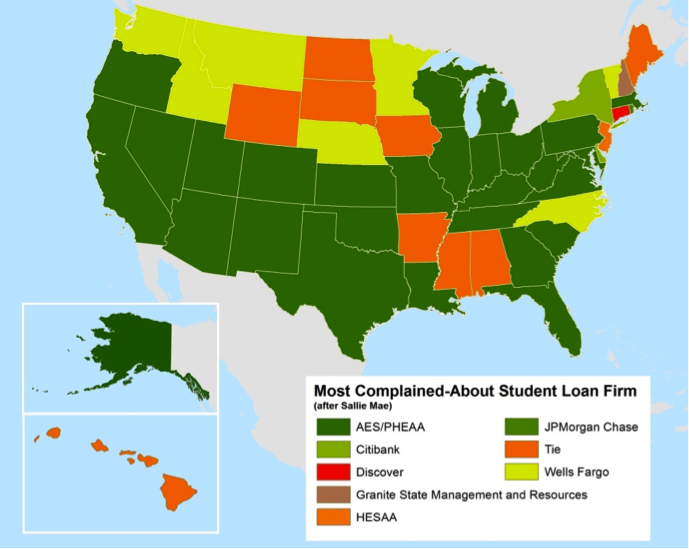

· Excluding Sallie Mae, AES/PHEAA was the most complained-about private student loan firm in 28 states. Wells Fargo was the most complained-about company (other than Sallie Mae) in seven states, while Citibank was most complained-about in three and Discover in one.

Figure ES-1. Most Complained-About Private Student Loan Firm (other than Sallie Mae) in Each State[i]

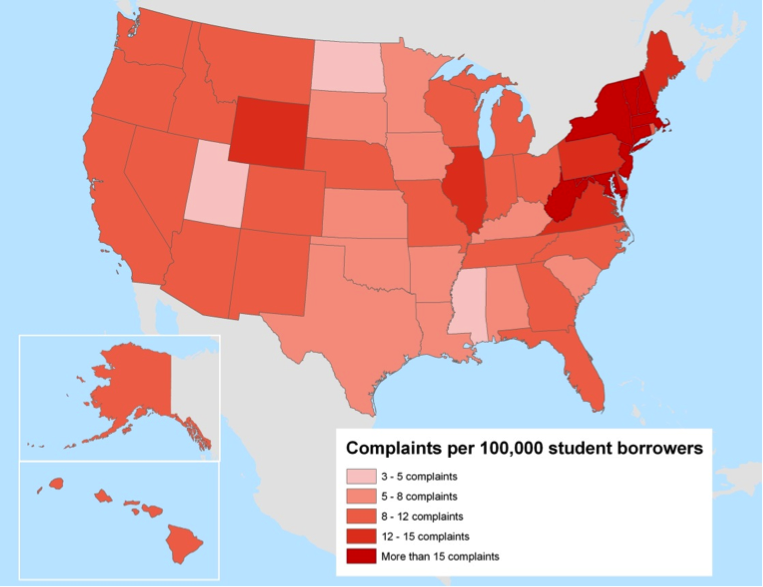

· Student loan borrowers in Northeastern states are most likely to complain about PSLs, while borrowers in the Midwest and South are least likely. The District of Columbia had the highest complaint-to-borrower ratio, followed by New Hampshire, Connecticut, Massachusetts, New York, Maryland and Vermont.

Figure ES-2. Complaints about Private Student Loans per 100,000 Student Borrowers, by State

· The variation in the ratio of complaints to student borrowers by state may reflect differences in the propensity of residents of each state to rely on private student loans, or other factors, such as differing levels of awareness of the CFPB database on the part of that state’s residents. States with higher average student loan debt tend to have borrowers who complain more frequently about private student lenders to the CFPB. Private student loans are disproportionately used by high-debt borrowers.

· The District of Columbia, Vermont, Massachusetts, Connecticut, Maryland, New York and New Jersey all ranked among the top 10 for complaints per 100,000 borrowers in both categories of issues that attracted large numbers of complaints to the CFPB (problems related to inability to pay and loan repayment). However, some states experienced large numbers of complaints in one category but not the other. Rhode Islanders were seventh most-likely to complain about problems resulting from an inability to pay, for example, but were 40th in complaints about loan repayment. Pennsylvanians were in the top 10 for complaints about loan repayment, but 22nd in complaints about problems resulting from inability to pay.

The CFPB is making a significant difference for student borrowers facing difficulty with their financial institutions.

· The CFPB has helped more than 330 consumers, or just under 8 percent, to receive monetary compensation to resolve their student loan complaints, with a median amount of monetary relief of $700 and maximum relief of over $75,000. More than 500 additional consumers, or 12 percent, have had their complaints closed with some form of non-monetary relief.

· Private student loan companies vary greatly in the degree to which they respond to consumer complaints with offers of monetary relief. Almost 15 percent of consumers complaining to Discover Financial received offers of monetary relief, compared with slightly fewer than 2 percent of complaints regarding Nelnet.

· About 20 percent of responses received from private student loan firms to complaints filed with the CFPB were deemed unsatisfactory by consumers and were subject to further dispute.

· Of companies with 10 or more overall complaints, the lender with the greatest proportion of disputed responses was First Associates Loan Servicing LLC, with 40 percent of complaint responses disputed by consumers. Of these same lenders, PNC Bank had the highest proportion of complaints resolved without dispute, with less than 6 percent of complaint responses disputed.

The Consumer Financial Protection Bureau’s Consumer Complaint Database is a key resource for consumer protection. To enhance the effectiveness of the CFPB in addressing consumer complaints:

· The CFPB should make the Consumer Complaint Database more user-friendly by adding, among other data, more narrative information and detailed information about consumer complaints, including how they were resolved, and the reasons for and outcomes of any disputes, with specific monetary relief amounts, if any, included. The CFPB should also conduct more frequent analyses of trends and give users the tools to undertake their own analyses of the data. In addition, the CFPB should make it easier for analysts to link the Consumer Complaint Database to other government databases.

· The CFPB should expand public awareness of how to file complaints and access the Consumer Complaint Database by working with regulators to disseminate information about the complaints process to consumers.

· The CFPB should develop free smartphone applications (“apps”) for consumers to access information about how to complain about a firm and how to review complaints in the database.

· The CFPB should conduct surveys among consumers and companies involved in disputes, and continue to improve its own customer service capacity through the complaints system.

To improve the effectiveness of the CFPB, the agency should:

· Move quickly to implement strong consumer protection rules based on additional research into the opaque and heavily concentrated student loan market, in order to protect student loan borrowers from predatory practices.

· Where problems are identified, use the information gathered from the database, from supervisory and examination findings, and from other sources to require a high, uniform level of consumer protection, through guidance and rules, to protect consumers and ensure that responsible industry players can better compete with those who are using harmful practices.

· Press colleges and universities to certify the safety and quality of private student loans before encouraging their students to borrow.

* As of August 6, 2013

[i] Sallie Mae was the most complained about lender in every state other than Alaska and Minnesota.

Topics

Find Out More

5 steps you can take to protect your privacy now

Too much to recall